Estimated targets do not represent or guarantee the actual results of any transaction, and no representation is made that any transaction will, or is likely to, achieve results or profits similar to those shown. The MIRR allows project managers to change the assumed rate of reinvested growth from stage to stage in a project. The most common method is to input the average estimated cost of capital, but there is flexibility to add any specific anticipated reinvestment rate. Companies and analysts may also look at the return on investment (ROI) when making capital budgeting decisions. ROI tells an investor about the total growth, start to finish, of the investment. The two numbers normally would be the same over the course of one year but won’t be the same for longer periods of time.

The IRR function can be found by clicking on the Formulas Insert (fx) icon. The amount of cash received by an investor in exchange for equity invested is measured by the equity multiple. Both IRR and equity multiple are crucial financial measures to evaluate, but if investors place too much emphasis on IRR, they may ignore opportunities that provide higher equity returns.

Equivalent Annual Annuity

However, NPV may not reflect the relative profitability of a project or investment, as it does not account for the size or duration of the cash flows. When you encounter multiple IRRs, you need to be careful about which one to use for decision making and performance evaluation. MIRR eliminates the problem of multiple IRRs by providing a unique and consistent measure of return. However, MIRR may not reflect the true profitability of a project or investment, as it ignores the actual reinvestment rate of the cash flows.

Investment advisory services are provided by EM Advisor, LLC, an investment advisor registered with the Securities and Exchange Commission. Nothing on this website is intended as an offer to extend credit, an offer to purchase or sell securities or a solicitation of any securities transaction. Our dedicated Investor Relations Team is standing by to help simplify your real estate investing process. The first limitation of MIRR is that it requires you to compute an estimate of the cost of capital in order to make a decision, a calculation that can be subjective and vary depending on the assumptions made. Any project with an IRR that exceeds the RRR will likely be deemed profitable, although companies will not necessarily pursue a project on this basis alone. Rather, they will likely pursue projects with the highest difference between IRR and RRR, as these will likely be the most profitable.

Aadi Bioscience Announces Financial Results for the Second … – PR Newswire

Aadi Bioscience Announces Financial Results for the Second ….

Posted: Wed, 09 Aug 2023 12:00:00 GMT [source]

The detailed information about its cash inflows and outflows is presented in the table below. Cash flow management is a vital skill for any business or investor, as it affects the liquidity, profitability, and sustainability of your operations. To improve your cash flow management skills, you need to understand the concepts and tools of financial analysis, such as IRR, NPV, MIRR, and others.

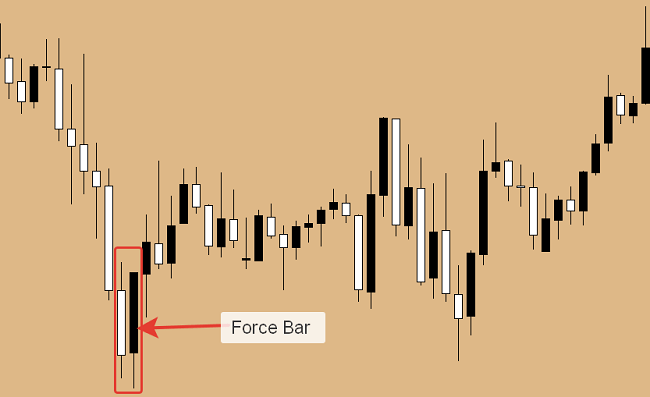

While both projects could add value to the company, it is likely that one will be the more logical decision as prescribed by IRR. Note that because IRR does not account for changing discount rates, it’s often not adequate for longer-term projects with discount rates that are expected to vary. Generally speaking, the higher an internal rate of return, the more desirable an investment is to undertake. IRR is uniform for investments of varying types and, as such, can be used to rank multiple prospective investments or projects on a relatively even basis. In general, when comparing investment options with other similar characteristics, the investment with the highest IRR probably would be considered the best. The first series is the conventional cash-flow pattern, which has one sign change, i.e. it has initial cash out flow followed by five continuous periods of net cash inflows.

Cash Flow Management

The modified internal rate of return (MIRR) compensates for this flaw and gives managers more control over the assumed reinvestment rate from future cash flow. The internal rate of return (IRR) is a financial metric used to assess the attractiveness of a particular investment opportunity. When you calculate the IRR for an investment, you are effectively estimating the rate of return of that investment after accounting for all of its projected cash flows together with the time value of money. When selecting among several alternative investments, the investor would then select the investment with the highest IRR, provided it is above the investor’s minimum threshold. The main drawback of IRR is that it is heavily reliant on projections of future cash flows, which are notoriously difficult to predict. It can be misconstrued or misinterpreted if used outside of appropriate scenarios.

- If a firm can’t find any projects with an IRR greater than the returns that can be generated in the financial markets, then it may simply choose to invest money in the market.

- This means that there are two internal rates of return at which the net present value of the cash flow is equal to 0.

- The modified internal rate of return (MIRR) assumes that positive cash flows are reinvested at the firm’s cost of capital and that the initial outlays are financed at the firm’s financing cost.

As with IRR, the MIRR can provide information that leads to sub-optimal decisions that do not maximize value when several investment options are being considered at once. MIRR does not actually quantify the various impacts of different investments in absolute terms; NPV often provides a more effective theoretical basis for selecting investments that are mutually exclusive. It may also fail to produce optimal results in the case of capital rationing. WACC is a measure of a firm’s cost of capital in which each category of capital is proportionately weighted.

Syntax of the IRR Formula

All sources of capital, including common stock, preferred stock, bonds, and any other long-term debt, are included in a WACC calculation. A larger IRR may or may not indicate a better investment, depending on the investor’s strategy. Property #1, for example, returns more cash to an investor faster, but it also returns less cash over the course of a 5-year investment horizon. Although IRR is sometimes referred to informally as a project’s “return on investment,” it is different from the way most people use that phrase. Often, when people refer to ROI, they are simply referring to the percentage return generated from an investment in a given year or across a stretch of time. But that type of ROI does not capture the same nuances as IRR, and for that reason, IRR is generally preferred by investment professionals.

The second problem is that the assumption that positive cash flows are reinvested at the IRR is considered impractical in practice. With the MIRR, only a single solution exists for a given project, and the reinvestment rate of positive cash flows is much more valid in practice. The internal rate of return (IRR) is a metric used in financial analysis to estimate the profitability of potential investments. IRR is a discount rate that makes the net present value (NPV) of all cash flows equal to zero in a discounted cash flow analysis.

The Difference Between MIRR and IRR

Meanwhile, the internal rate of return (IRR) is a discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero. Excel allows a user to manipulate with multiple internal rates of return using the IRR function. This step by step tutorial will assist all levels of Excel users to learn how to solve issues with a multiple IRR in Excel. ROI figures can be calculated for nearly any activity into which an investment has been made and an outcome can be measured.

Another major issue with IRR occurs when a project has different periods of positive and negative cash flows. In these cases, the IRR produces more than one number, causing uncertainty and confusion. The internal rate of return (IRR) is a metric used to estimate the return on an investment. As the same calculation applies to varying investments, it can be used to rank all investments to help determine which is the best. Conversely, if the IRR on a project or investment is lower than the cost of capital, then the best course of action may be to reject it. Overall, while there are some limitations to IRR, it is an industry standard for analyzing capital budgeting projects.

Modified Internal Rate of Return (MIRR)

Even if the equity multiple is high, investors may instantly rule out a property with a low IRR. The idea for this is that if the IRR isn’t high enough, the trade may not be worthwhile. In this post, we’ll look at the differences between equity multiples and internal rate of return, as well as why a high IRR isn’t always a good thing.

President Biden activated the Individual Ready Reserve – Yahoo News

President Biden activated the Individual Ready Reserve.

Posted: Mon, 17 Jul 2023 07:00:00 GMT [source]

If you are involved in cash flow management, you may have encountered situations where the internal rate of return (IRR) of a project or investment is not unique or does not exist. This can pose a challenge for decision making and performance evaluation. In this article, you will learn how to deal with multiple IRRs or no IRR scenarios, and what are the alternatives and limitations of using IRR as a criterion.

Is IRR the Same as ROI?

In the case of positive cash flows followed by negative ones and then by positive ones, the IRR may have multiple values. Moreover, if all cash flows have the same sign (i.e., the project never turns a profit), then no discount rate will produce a zero NPV. It has to discount the growth from the initial investment in addition to reinvested cash flows. However, the IRR does not paint a realistic picture of how cash flows are actually pumped back into future projects. The calculation is a solution to two major problems that exist with the popular IRR calculation. The first main problem with IRR is that multiple solutions can be found for the same project.

The modified internal rate of return (MIRR) assumes that positive cash flows are reinvested at the firm’s cost of capital and that the initial outlays are financed at the firm’s financing cost. By contrast, the traditional internal rate of return (IRR) assumes the multiple irr cash flows from a project are reinvested at the IRR itself. The MIRR, therefore, more accurately reflects the cost and profitability of a project. IRR is not the only criterion for cash flow management, and there are some alternatives and limitations to consider.

Son yorumlar